Risk adjustment requires constant attention to ensure accurate coding, timely regulatory compliance, and streamlined communications across the payer-provider continuum. Increasingly rigorous oversight from the Centers for Medicare & Medicaid Services (CMS) and Office of the Inspector General (OIG) are calling for better diligence, planning and administrative oversight for effective risk adjustment.

The January 2023 rule from CMS, which struck the fee-for-service adjuster from risk adjustment data validation (RADV) audits, has also increased concern among Medicare Advantage (MA) plans. Put into effect with the goal of recouping unjustified costs, CMS estimates a recovery of more than $4.7 billion in overpayments to MA plans with this new audit methodology over the next ten years. One major payer recently filed a lawsuit against CMS contesting the validity of these changes as 17% of its 2023 earnings came under question under the new rule.

With such financial stakes, payers are charged with keeping a keen eye on their risk adjustment efforts. OIG provides a number of toolkits for improving risk adjustment efforts, but keeping track of all requirements can still seem overwhelming.

Consider these three key components for better risk adjustment success: the benefits of ongoing training, combining digital and traditional record retrieval methods, and thoughtfully integrating new advanced technologies alongside human expertise across the organization.

1. Improving coding training and best practices

Achieving better risk adjustment results starts with ongoing training efforts and proactively planning for overpayments.

Investing in ongoing coding trainings

While most plans know that the regulatory environment is going to change every year, keeping on top of training for these coding changes might not be getting due attention. Executing ongoing training on a consistent basis helps ensure that coding is as current as possible.

Conducting audits, assessing retrospective events, and continuously analyzing data lets plans see areas for improvement in real-time, making adjustments and tweaks on an ongoing basis rather than realizing big changes annually and having to make substantial, potentially disruptive changes. Providers benefit from this continuous training as well, as plans can give feedback or provider education as necessary to improve coding efforts on their end.

For plans that lack the bandwidth to execute continuous training in-house or lack the budget to hire a vendor to assist them with tackling this challenge, reviewing project results for takeaways is key. Regularly analyzing results helps to periodically uncover any existing gaps in coding or anything that doesn’t align with the medical record. Another important time to evaluate results is after a risk adjustment data validation (RADV) audit, assessing any errors or patterns and gleaning trends from the results.

Planning for overpayments

While ongoing training helps to minimize coding errors, plans should proactively anticipate the financial implications of overpayments as a contingency plan.

The likelihood of having to return overpayments from the Centers for Medicare & Medicaid Services (CMS) is considerable, underscoring the importance of being proactive when it comes to improving risk adjustment coding. In August 2023, OIG audits identified approximately $377 million in risk adjustment overpayments based on inaccurate coding. As RADV and Office of Inspector General (OIG) audits and enforcement actions persist and potentially intensify, payers should work together with finance teams to think ahead for any potential financial losses.

The recent prevalence of paying high costs for erroneous coding is starting to get increased attention. In one recent audit, OIG found at least $3.7 million in overpayments to just one plan over the course of two years. Payers are becoming more wary of overpayments due to CMS codifying the final RADV rule in 2023, confirming the methodology for extrapolating findings. Planning for possible overpayments helps payers brace for impact and helps maintain financial stability through audits and regulatory scrutiny.

2. Streamlining digital and traditional record retrieval methods

While digital medical records and patient portals are becoming the new standard for many providers, the journey from paper to portal has been slow. Though a 2021 study found that 78% of office-based physicians adopted a certified electronic health record (EHR) system, as recently as 2019, 68% of acute care hospitals were still using mail or fax to transmit medical records. Many payers are looking to collaborate with providers to streamline record retrieval for better accuracy and efficiency.

Standardizing data enrichment processes can be a strong step towards better data retrieval. With many providers using a variety of different technologies to capture data, aggregating data from all of the varied EMR systems can result in data duplicates and other errors than need to be corrected after the fact. For example, differences in medication lists due to varying documentation practices can be a problem that would easily be corrected by a standard data enrichment process. By normalizing data, plans can help ensure that data is correct, reliable, and actionable to drive stronger risk adjustment outcomes.

Outreach tactics are also paramount for accurate risk adjustment outcomes, including OIG and RADV audits, since any records that can’t be procured to support member conditions will be considered unsupported conditions. Plans should make sure that their teams are maintaining the correct, key contacts at each provider office and effective communication for proper medical record retrieval. Plans should also take time to get a grasp of provider site mapping, mapping provider national provider identifier (NPI) number to the correct tax identification number (TIN). Doing so can help with any confusion around multiple sites and can be an opportunity to look for different ways to tailor approaches and optimize retrieval methods for each provider site. Keeping track of a provider’s preferred contact methods, for example, can help improve retrieval outcomes. The best way to do this is to strategize an “activation plan” for delegating retrieval responsibilities to a dedicated task force that can make these important connections, alleviating the burden of internal management and streamlining retrieval.

In a perfect world, plans and providers are able to transmit data accurately, efficiently, and securely without the need for printing and scanning and faxing. While the healthcare continuum continues to move slowly in that direction, in the meantime, by meeting providers where they are and streamlining communications between the plan and the provider, payers can anticipate and minimize administrative burden and optimize processes for better data accessibility.

3. Assessing priorities for artificial intelligence

While so much of effective risk adjustment relies on providers and medical records, health plans also need to take time to assess themselves and find areas ripe for improvement. Defining organizational priorities should start with a comprehensive overview of their infrastructure, markets, and technologies. Establish what can be improved for legislative compliance and technical prowess in data retrieval while considering what is reliable and scalable.

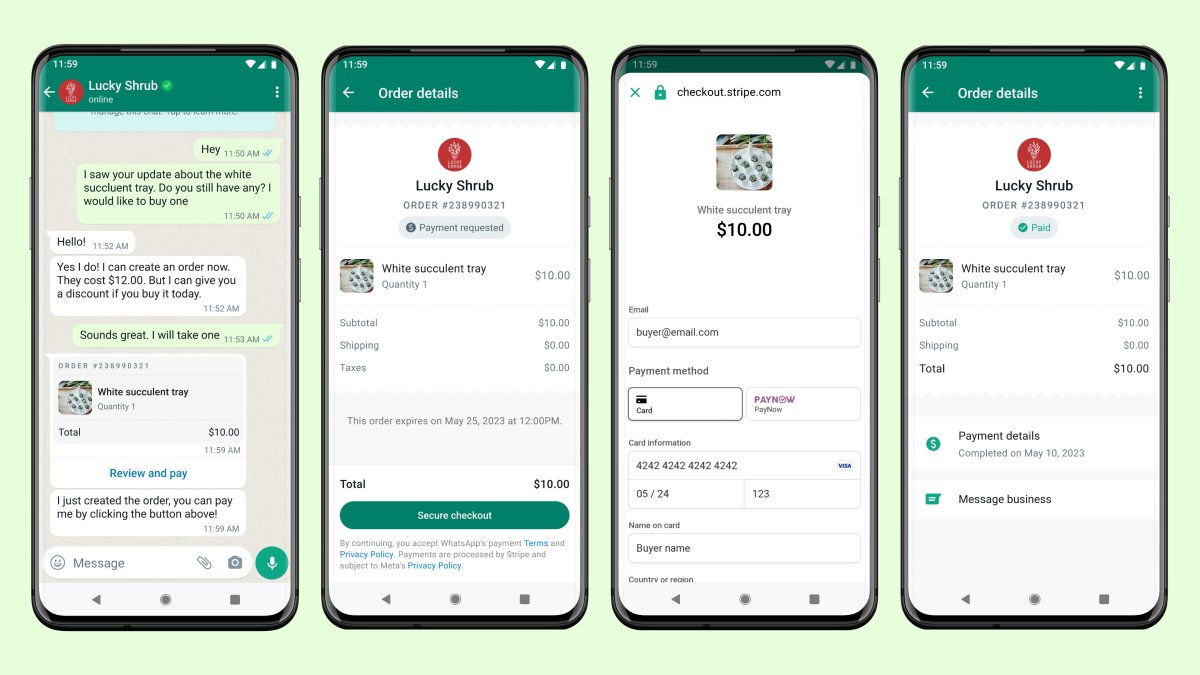

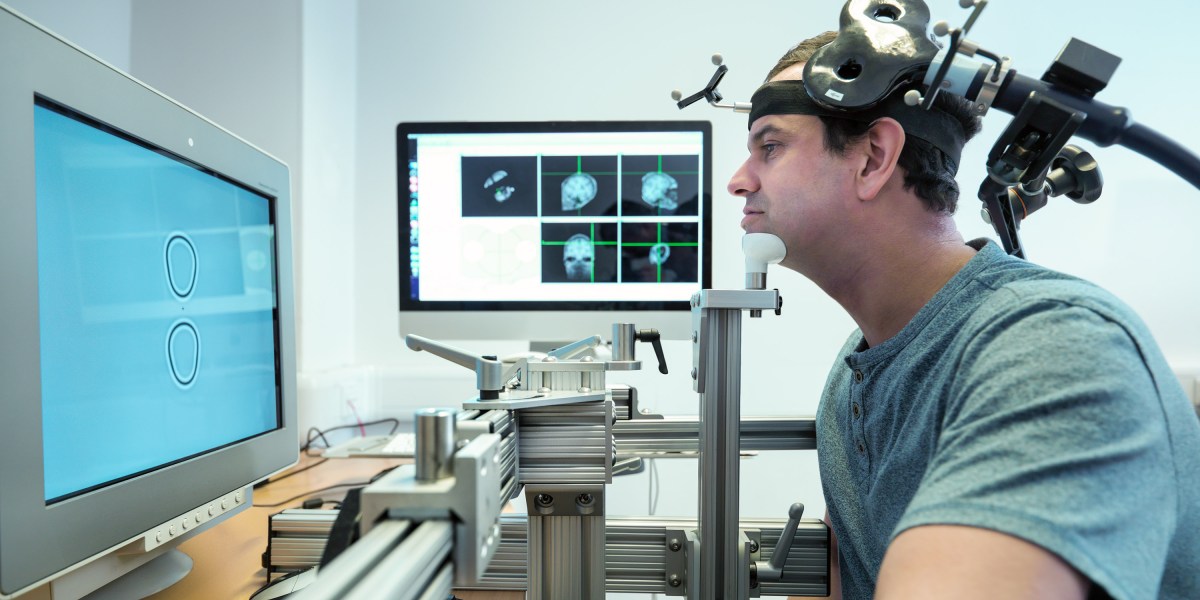

Artificial intelligence (AI) has gained traction in recent years, and its possibilities are being increasingly leveraged by the healthcare industry. As its reliability improves, combining the speed of artificial intelligence (AI) with human oversight can help streamline record retrieval efforts within risk adjustment. Natural language processing (NLP) is one such use case. Rather than flipping through a medical record that could be hundreds or thousands of pages long, NLP can help spot key phrases related to conditions that coders are investigating and even offer up suggested related codes for the phrase. NLP can also help color-code the record for different trends, pulling key elements out of the medical record to make it more visually identifiable to the coder and help aid a very potentially lengthy chart review process.

Having a high-performing partner or vendor can also help plans to prioritize where to put their energies, or to help with scaling technologies and leveraging analytics. A high-performing analytics and suspecting team can target medical records quickly and efficiently, where internal teams may take longer or be burdened with multiple competing priorities. For example, partnering with a vendor can open up the ability to look at each member and the historic information about that member:

- Did they have diabetes last year?

- Did they have it the year before?

- Was it captured at all in 2024?

- Which type of provider has that member gone to?

When evaluating a suspected diabetes coding gap, the record request isn’t sent to a chiropractor or dermatologist, it should go to the primary care or endocrinology provider offices. A good suspecting and analytics team knows those algorithms and can look at the historic data about the member population and figure out which members might have conditions that may not have been captured.

For members with conditions that are frequently miscoded or that could carry significant risk, it’s imperative to have a team that can spend time going back and looking at those records to make sure that the documentation supports it. A high-performing team will help ensure that diagnoses are not overreported or underreported, and that any trends noted with particular providers, locations, or documentation practices can be gleaned and acted upon.

Whether working with an internal or vendor risk adjustment team, all plans should assess each project for the results that it yielded. How high was your confidence in different locations you visited? If researching a specific member, did you actually find any coding errors in the chart? If there were a certain number of members and charts that required further scrutiny, how many of those yielded findings? Did you find additional conditions that lacked the appropriate coding? Did you correct coding errors and mitigate risk for your health plan? Defining the rate of gap closure and the level of confidence will tell you the areas that need work.

There are many ways that health plans can optimize risk adjustment efforts to meet increasing scrutiny from OIG and CMS around risk adjustment standards. By improving ongoing coding trainings, financially preparing for overpayments, integrating digital and manual efforts, and assessing viability for new technology innovations, MA plans can take a step in the right direction towards better compliance and improve the sustainability of their operations.

About Katie Sender, MSN, RN, PHN, CRC

With over 25 years of healthcare experience, Katie Sender is responsible for leadership and management oversight of teams spanning the globe to ensure optimal client outcomes and service delivery through Cotiviti’s Clinical and Coding solutions.